Should Fixed Overhead Be Expensed Even When There Is No Production

Stock-still Manufacturing Overhead: Standard Toll, Budget Variance, Volume Variance

Fixed manufacturing overhead costs remain the aforementioned in total even though the product volume increased by a pocket-size amount. For instance, the property tax on a large manufacturing facility might be $50,000 per year and information technology arrives equally one tax bill in December. The corporeality of the property tax bill did not depend on the number of units produced or the number of machine hours that the plant operated. A few of the many examples of fixed manufacturing overhead costs include the depreciation or rent on product facilities; salaries of production managers and maintenance supervisors; and professional memberships and training for managers in the manufacturing area. Although the fixed manufacturing overhead costs present themselves as large monthly or annual expenses, they are part of each production's price.

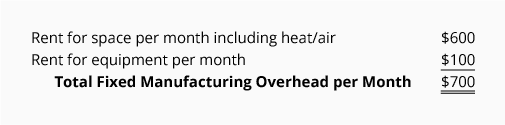

DenimWorks has two fixed manufacturing overhead costs:

A portion of these fixed manufacturing overhead costs must be allocated to each apron produced. This is known equally absorption costing and information technology explains why some accountants say that each product must "absorb" a portion of the fixed manufacturing overhead costs.

A simple manner to assign or allocate the fixed costs is to base of operations information technology on things such as direct labor hours, machine hours, or pounds of directly material. Accountants realize that this is simplistic; they know that overhead costs are caused past many dissimilar factors. However, we will assign the fixed manufacturing overhead costs to the aprons by using the direct labor hours.

Establishing a Predetermined Rate

Companies typically found a standard fixed manufacturing overhead rate prior to the first of the year and and then use that rate for the entire year. Let's assume it is December 2020 and DenimWorks is developing the standard fixed manufacturing overhead rate for use in 2021. As mentioned above, nosotros will assign the fixed manufacturing overhead on the footing of direct labor hours.

Stride one.

Estimate the stock-still manufacturing overhead costs for the yr 2021.

We indicated above that the stock-still manufacturing overhead costs are the rents of $700 per calendar month, or $8,400 for the year 2021.

Stride 2.

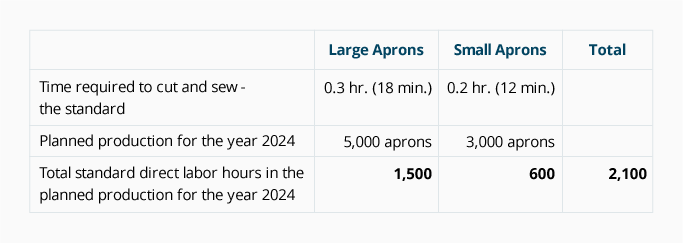

Estimate the total number of standard direct labor hours that are needed to manufacture your products during 2021.

We can estimate the direct labor hours from the data given before (and repeated here):

Step 3.

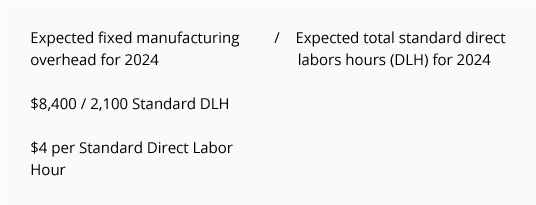

Compute the standard fixed manufacturing rate to be used in 2021.

Note:

One reason a company develops a predetermined annual rate is to accept a uniform rate for all months. If the company used monthly rates, the charge per unit would be high in the months when few units are produced (monthly stock-still costs of $700 ÷ 100 units produced = $seven per unit) and depression when many units are produced (monthly fixed costs of $700 ÷ 350 units = $2 per unit).

Fixed Manufacturing Overhead Budget Variance

The difference between the bodily amount of fixed manufacturing overhead and the estimated amount (the amount budgeted when setting the overhead rate prior to the first of the yr) is known every bit the fixed manufacturing overhead budget variance.

In our case, nosotros approaching the annual fixed manufacturing overhead at $8,400 (monthly rents of $700 x 12 months). If DenimWorks pays more $8,400 for the twelvemonth, there is an unfavorable budget variance; if the company pays less than $8,400 for the yr, there is a favorable upkeep variance.

Stock-still Manufacturing Overhead Volume Variance

Recall that the fixed manufacturing overhead costs (such equally the large corporeality of hire paid at the start of every calendar month) must be assigned to the aprons produced. In other words, each apron must absorb a small portion of the stock-still manufacturing overhead costs. At DenimWorks, the fixed manufacturing overhead is assigned to the good output by multiplying the standard rate by the standard hours of direct labor in each apron. Hopefully, past the end of the year there will be enough good aprons produced to absorb all of the stock-still manufacturing overhead costs.

The fixed manufacturing overhead volume variance is the deviation between the amount of fixed manufacturing overhead approaching to the amount that was applied to (or absorbed by) the good output. If the amount applied is less than the corporeality budgeted, there is an unfavorable book variance. This means at that place was not enough skillful output to absorb the budgeted corporeality of fixed manufacturing overhead. If the amount applied to the skillful output is greater than the budgeted amount of fixed manufacturing overhead, the stock-still manufacturing overhead volume variance is favorable.

Analogy of Fixed Manufacturing Overhead Variances for 2021

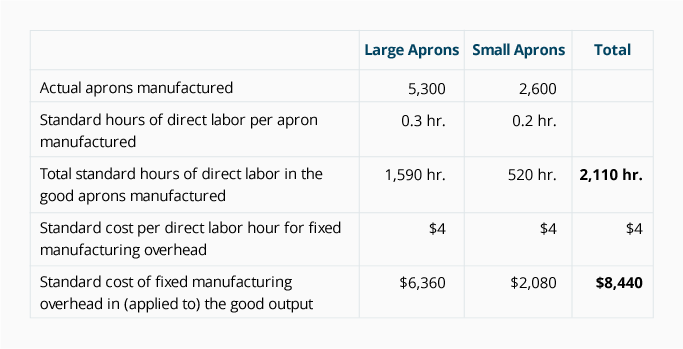

Allow's assume that in 2021 DenimWorks articles (has actual good output of) five,300 large aprons and 2,600 small aprons. Allow'southward also assume that the actual stock-still manufacturing overhead costs for the year are $8,700. Equally nosotros calculated before, the standard fixed manufacturing overhead rate is $4 per standard direct labor hour.

Nosotros begin past determining the stock-still manufacturing overhead applied to (or absorbed past) the good output produced in the twelvemonth 2021. Recollect that we apply the overhead costs to the aprons by using the standard amount of directly labor hours.

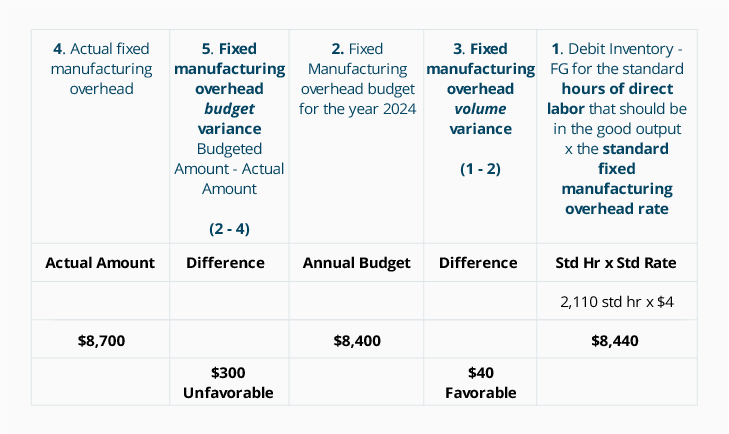

Our analysis looks similar this:

Stock-still Manufacturing Overhead Analysis for the Year 2021:

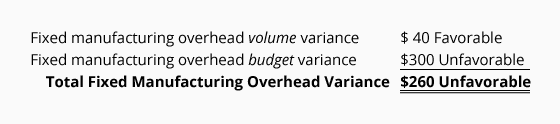

This analysis shows that the actual stock-still manufacturing overhead costs are $viii,700 and the stock-still manufacturing overhead costs applied to the adept output are $8,440. This unfavorable difference of $260 agrees to the sum of the 2 variances:

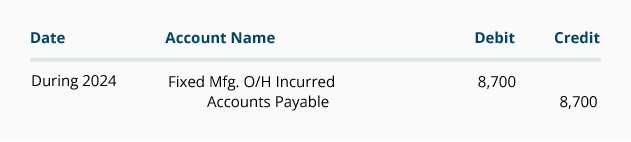

The actual fixed manufacturing overhead costs are debited to overhead price accounts. The credits are made to accounts such as Accounts Payable or Greenbacks. For example:

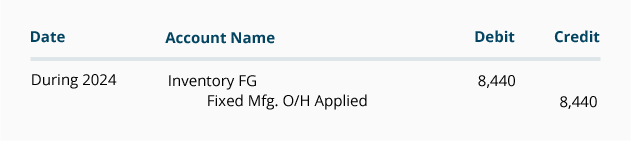

Another entry records how these overheads are assigned to the product:

We volition discuss how to report the balances in the variance accounts under the heading What To Do With Variance Amounts.

Should Fixed Overhead Be Expensed Even When There Is No Production,

Source: https://www.accountingcoach.com/standard-costing/explanation/5

Posted by: walkerpuring93.blogspot.com

0 Response to "Should Fixed Overhead Be Expensed Even When There Is No Production"

Post a Comment